The Case for Digital Stress Testing – Ensuring Resilience Beyond Compliance

Rick Lemieux – Co-Founder and Chief Product Officer of the DVMS Institute

The New Reality of Digital Dependence

In today’s hyper-connected economy, organizations depend on digital infrastructure just as nations rely on their financial systems. Data platforms, supply chains, and AI-driven operations form the arteries of modern business. Yet, while central banks routinely stress test financial institutions to ensure systemic stability, few organizations apply the same rigor to their digital ecosystems.

The outcome is predictable: organizations may look compliant on paper, yet crumble under digital pressure. As outlined in the DVMS Institute’s white paper, “The Assurance Mandate,” it’s time to recognize digital resilience as a strategic imperative—not a technical afterthought.

From Financial Stress Tests to Digital Assurance

Banking regulators have learned long ago that static compliance is insufficient. Following the 2008 financial crisis, regulators introduced stress testing to expose vulnerabilities that traditional audits had missed. These tests simulate market shocks, liquidity shortages, and operational crises to ensure banks can absorb disruption and continue serving the economy.

Digital systems require the same logic. Cyberattacks, supply chain breakdowns, and AI failures can now trigger systemic risks equal to financial contagion. A digital stress test is the organizational equivalent: a structured, evidence-based exercise that measures whether critical services can continue to create, protect, and deliver value when systems fail. Just as regulators no longer accept financial stability on trust, boards should not accept digital stability based solely on certifications.

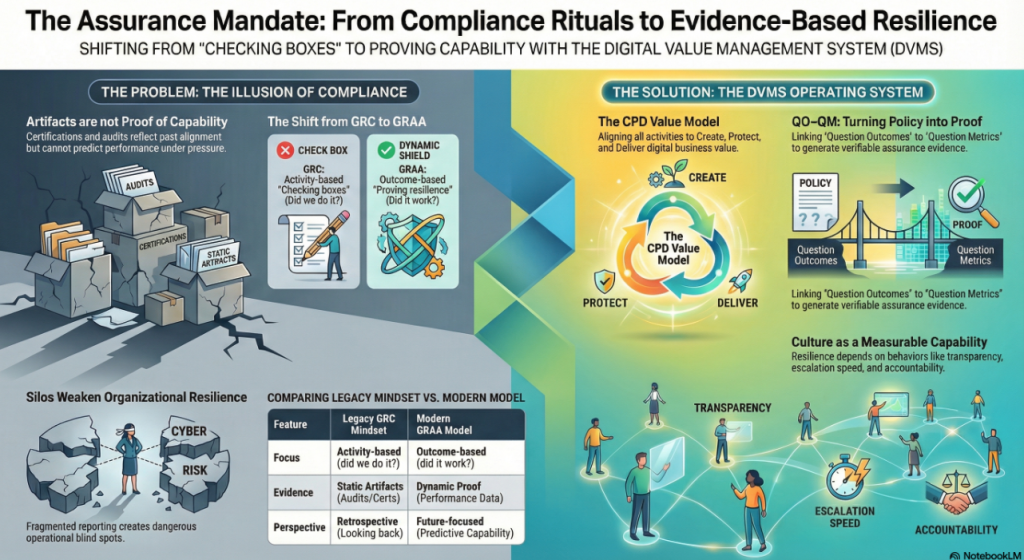

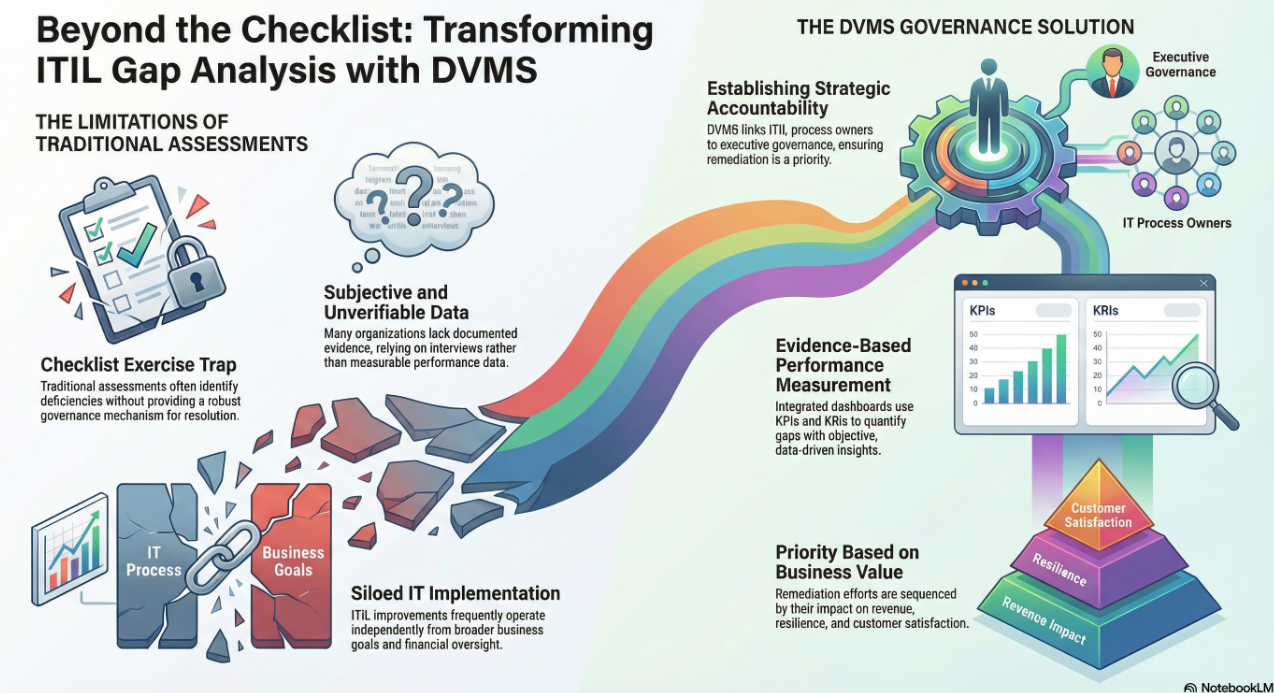

Why Compliance Isn’t Confidence

Traditional governance frameworks and standards—such as NIST, GRC, ISO, and ITSM—are essential maps, but they are not the journey itself. They ensure organizations look orderly but don’t prove they can perform under stress. SolarWinds, Snowflake, and Colonial Pipeline all maintained impressive certifications before their crises. These artifacts offered reassurance, not resilience. Compliance measures alignment, not adaptability. It tells us whether policies exist, not whether people and systems will act effectively when chaos hits. In the same way that a bank’s capital ratios mean little without real-world liquidity tests, a cybersecurity audit means little without proof that controls hold when adversaries adapt. Stress testing bridges this gap between documentation and demonstrated capability.

The Digital Value Management System Advantage

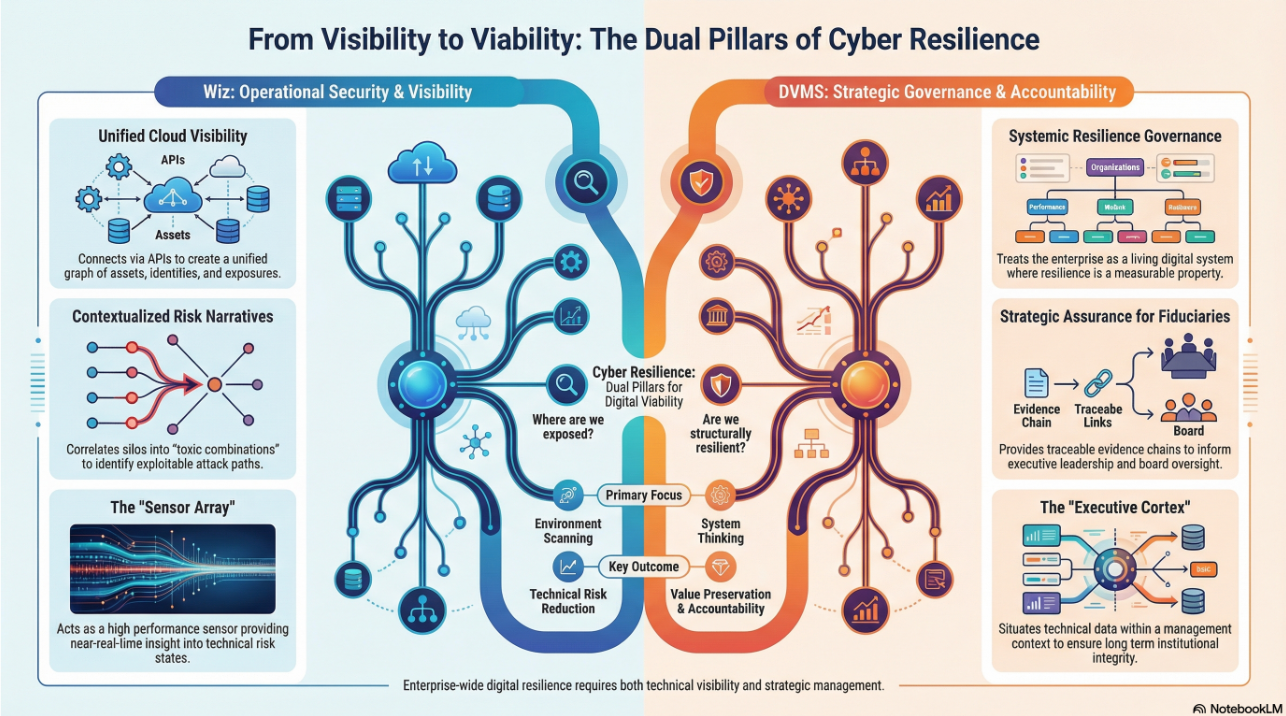

The Digital Value Management System (DVMS) provides the operating system for institutionalizing these stress tests. As The Assurance Mandate explains, a DVMS evolves fragmented, control-driven programs (NIST, ITSM, GRC, ISO) into a unified, adaptive governance, resilience, and assurance system.

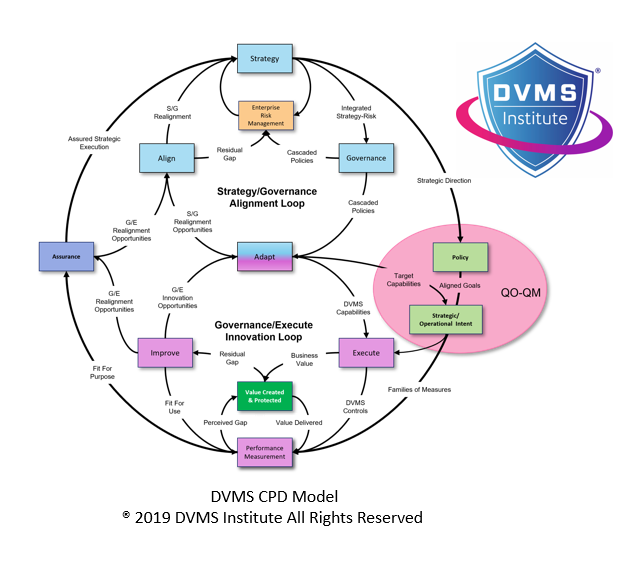

Rather than replacing existing frameworks, it overlays them—connecting governance intent, operational processes, and assurance evidence in one continuous loop. Through its Create–Protect–Deliver (CPD) model, a DVMS assesses whether digital value creation remains viable in the face of stress. It asks: Can we still create value? Can we still protect it? Can we still deliver it? The system translates these questions into measurable outcomes and real-time evidence.

This approach mirrors the financial sector’s use of scenario-based testing, where performance under adverse conditions determines confidence in stability.

The Illusion of Safety in Fragmented Systems

Just as interbank risk once went unseen until a crisis exposed it, digital fragility often remains hidden within organizational silos. IT, cybersecurity, and compliance frequently operate independently, each claiming success through isolated metrics. But resilience is systemic. If one domain fails to communicate, the whole enterprise falters. Stress testing forces convergence, as it reveals dependencies among governance, operations, and culture. For example, a DVMS-driven stress test might simulate a cloud outage or ransomware attack, tracing not only technical responses but also decision-making, communication, and recovery time. When done regularly, these exercises generate assurance evidence—proof that the organization’s integrated systems can withstand and adapt to changes.

Culture: The Invisible Variable

Peter Drucker’s adage that “culture eats strategy for breakfast” applies equally to controls. Boeing, Equifax, and Colonial Pipeline demonstrate how compliance can collapse when culture discourages escalation or transparency. Stress testing exposes these weaknesses.

A digital stress test measures not only whether controls exist, but whether people act on them. Do teams escalate incidents quickly? Do executives prioritize continuity over optics? Within a DVMS, culture becomes visible through evidence—how fast decisions are made, how cross-functional collaboration occurs, and whether lessons lead to continuous improvement. In this sense, digital stress testing is as much a test of leadership integrity as of technical robustness.

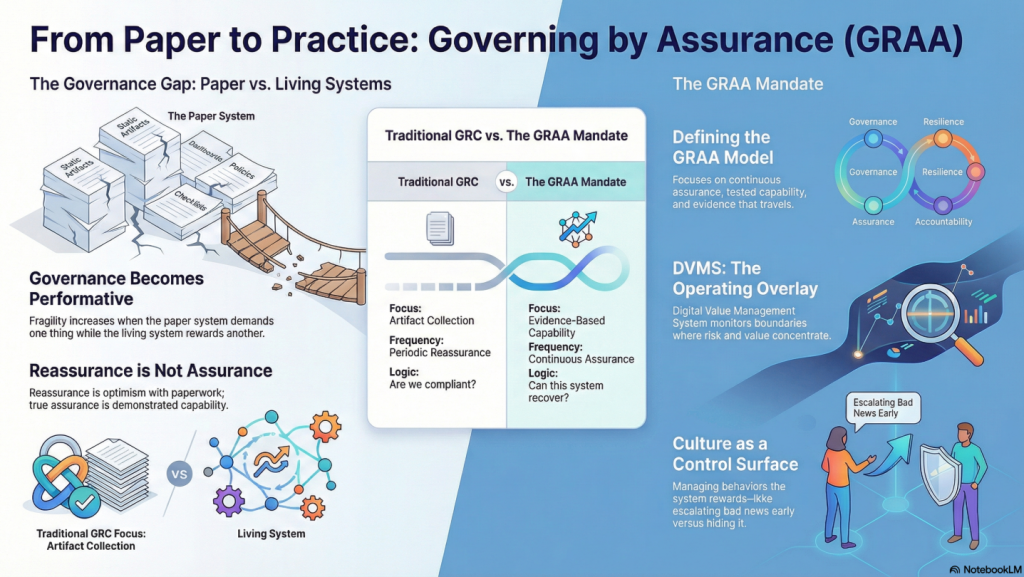

From Governance, Risk, and Compliance (GRC) to Governance, Resilience, and Assurance (GRA)

The Assurance Mandate frames this transition as the evolution from GRC to GRA—from retrospective documentation to forward-looking assurance. GRC informs boards about the controls that existed yesterday; GRA demonstrates how those controls will perform tomorrow. A stress-tested organization doesn’t just produce reports—it demonstrates capability under stress. This shift mirrors how regulators moved from paper-based oversight to live solvency tests. In both cases, the goal is to replace “trust us” with “test us.” The DVMS operationalizes GRA by providing boards with live, evidence-driven insights into resilience performance, rather than static maturity charts.

Technology as the Enabler

For decades, continuous assurance seemed too burdensome. Collecting and analyzing data across systems was slow and costly—the “burden of assurance”. AI and automation have changed that. Agentic systems now enable continuous monitoring, predictive analytics, and real-time feedback loops. A DVMS equipped with AI can track resilience indicators—such as recovery times, escalation speed, and vendor dependencies—just as financial regulators monitor capital adequacy ratios. Automated dashboards synthesize IT, cyber, and governance data into a single, board-level assurance view. The same tools that once fueled digital complexity can now make digital assurance practical.

Stress Testing as a Strategic Advantage

Organizations that treat stress testing as a regulatory chore miss its strategic potential. Financial institutions use stress test outcomes to refine their strategies, adjust portfolios, and strengthen their trust with investors. Similarly, digital stress testing can inform decisions regarding innovation and investment. When a DVMS reveals a resilience gap, it identifies an opportunity: redesign workflows, modernize vendor contracts, or automate recovery processes. Boards can then reframe assurance from defensive reporting to proactive improvement. Assurance becomes the engine of innovation—the feedback system that continuously raises organizational capability.

The Trust Dividend

In finance, stress testing rebuilt public trust after the crisis. In the digital economy, it can do the same. Stakeholders—customers, regulators, investors—are increasingly skeptical of compliance badges. They want evidence of continuity and integrity. By institutionalizing digital stress testing through a DVMS, organizations demonstrate transparency, accountability, and competence.

Trust, not technology, becomes the differentiator. Firms that can demonstrate resilience attract more investment, secure better partnerships, and maintain customer loyalty during crises. In an era where disruptions are inevitable, the ability to demonstrate assurance is the new measure of value.

Conclusion: From Reassurance to Confidence

Government regulators stress test banks because the collapse of one institution can endanger an entire economy. The same principle now applies to digital enterprises: a single systemic failure can ripple across supply chains, markets, and nations.

As The Assurance Mandate concludes, compliance brought us here; assurance will take us further. Stress testing digital systems is not about adding bureaucracy; it is about demonstrating maturity. Through the DVMS, organizations can evolve from managing frameworks to managing resilience—from reassuring stakeholders to giving them genuine confidence.

In short: resilience must be proven, not presumed. Just as the financial world learned that trust requires evidence, the digital world must now know the same lesson—before the subsequent systemic failure teaches it for us.

About the Author

Rick Lemieux

Co-Founder and Chief Product Officer of the DVMS Institute

Rick has 40+ years of passion and experience creating solutions to give organizations a competitive edge in their service markets. In 2015, Rick was identified as one of the top five IT Entrepreneurs in the State of Rhode Island by the TECH 10 awards for developing innovative training and mentoring solutions for boards, senior executives, and operational stakeholders.

DVMS Cyber Resilience Professional Accredited Certification Training

Teaching Enterprises How to Govern, Assure, and Account for Operational Resilience in Living Digital Ecosystems

Moving From Paper to Practice-Based Operational Resilience

Explainer Video – Governing By Assurance

Despite an abundance of frameworks, metrics, and dashboards, many leaders still lack a clear line of sight into how their digital value streams perform when conditions deteriorate.

Strategic intent, organizational structures, and day-to-day behaviors are evaluated separately, producing static snapshots that fail to reveal how decisions, dependencies, and human actions interact within a dynamic digital system.

The result is governance that appears comprehensive in documentation yet proves fragile under pressure, leaving leaders to reconcile disconnected controls rather than systematically strengthen operational resilience.

What is needed is a framework-agnostic operating overlay that enables operational resilience to be governed, assured, and accounted for coherently across complex, living digital ecosystems.

DVMS Institute White Papers – The Assurance Mandate Series

Explainer Video – From Compliance Rituals to Evidence-Based Resilience

The whitepapers below present a clear progression from compliance-driven thinking to a modern system of Governance, Resilience, Assurance, and Accountability (GRAA). Together, they define an evidence-based approach to building and governing resilient digital enterprises.

The Assurance Mandate Paper explains why traditional compliance artifacts offer reassurance, not proof, and challenges boards to demand evidence that value can be created, protected, and delivered under stress.

The Assurance in Action Paper shows how DVMS turns intent into execution by translating outcomes into Minimum Viable Capabilities, aligning frameworks through the Create–Protect–Deliver model, and producing measurable assurance evidence of real performance.

The Governing by Assurance Paper extends this model to policy and regulation, positioning DVMS as a learning overlay that links governance intent, operational capability, and auditable evidence—enabling outcome-based governance and proof of resilience through measurable performance data.

The Digital Value Management System® (DVMS)

Explainer Video – What is a Digital Value Management System (DVMS)

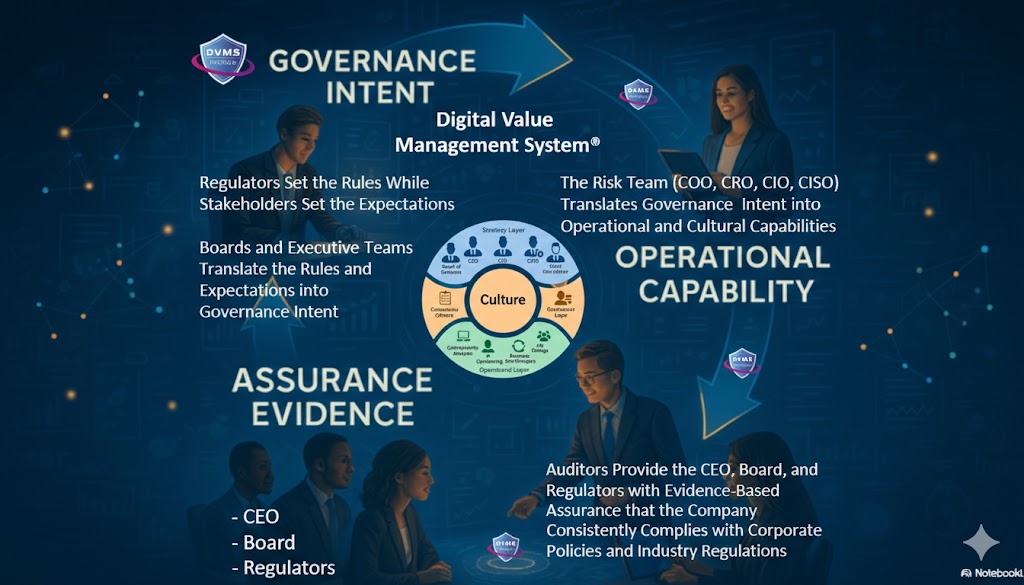

The DVMS is an overlay management system that governs, assures, and accounts for operational resilience in complex, living digital ecosystems. It does so by ensuring living-system outcomes account for paper-system intent.

At its core, the DVMS is a simple but powerful integration of:

- Governance Intent – shared expectations and accountabilities

- Operational Capabilities – how the digital business performs

- Assurance Evidence – proof that outcomes are achieved and accountable

- Cultural Learning – for governance intent and operational capability fine-tuning

Underpinning this integration are three distinctive DVMS models

Create, Protect, and Deliver (CPD) – The CPD Model™ is a systems-based model within the DVMS that links strategy-risk and governance to execution to create, protect, and deliver digital business value as an integrated, continuously adaptive capability.

3D Knowledge (3DK) – The 3D Knowledge Model is a systems-thinking framework that maps team knowledge over time (past, present, future), cross-team collaboration, and alignment to strategic intent to ensure that organizational behavior, learning, and execution remain integrated and adaptive in delivering digital business value.

Minimum Viable Capabilities (MVC) – The Minimum Viable Capabilities (MVCs) model supports the seven essential, system-level organizational capabilities—Govern, Assure, Plan, Design, Change, Execute, and Innovate—required to reliably create, protect, and deliver digital business value in alignment with strategy-risk intent.

The models work together to enable the following organizational capabilities:

A Governance Overlay that replaces fragmentation with unity. The DVMS provides organizations with a structured way to connect strategy with day-to-day execution. Leaders gain a consistent mechanism to direct, measure, and validate performance across every system responsible for digital value.

A Behavioral Engine that drives high-trust, high-velocity decision-making. The DVMS embeds decision models and behavioral patterns that help teams think clearly and act confidently, even in uncertain situations. It is engineered to reduce friction, prevent blame-based cultures, and strengthen organizational reliability.

A Learning System that makes culture measurable, adaptable, and scalable. Culture becomes a managed asset—not an abstract concept. The DVMS provides a repeatable way to observe behavior, collect evidence, learn from outcomes, and evolve faster than threats, disruptions, or market shifts.

DVMS Benefits – Organizational and Leadership

Explainer Video – DVMS Organization and Leadership Benefits

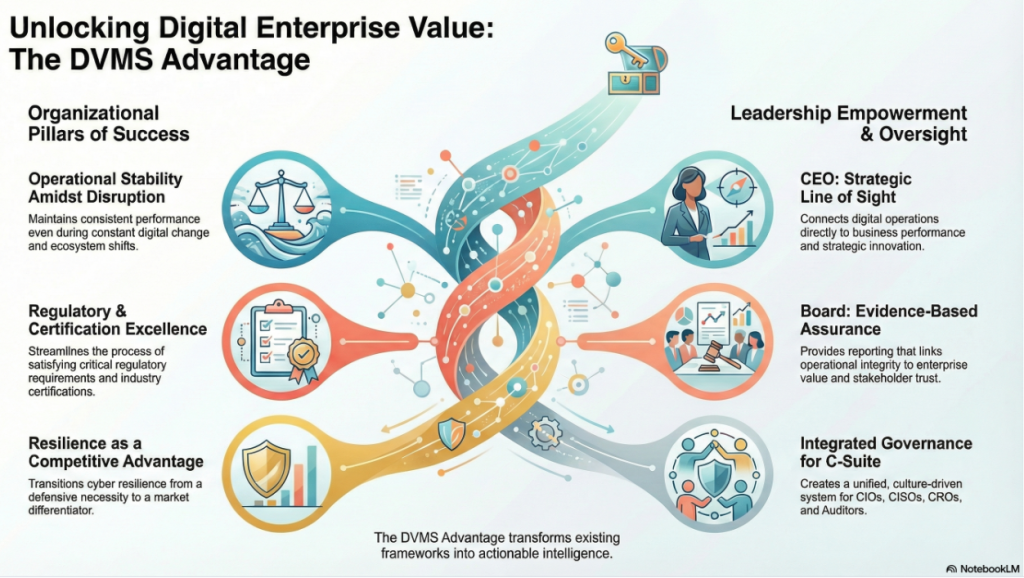

Instead of replacing existing operational frameworks and platforms, the DVMS elevates them, connecting and contextualizing their data into actionable intelligence that validates performance and exposes the reasons behind unmet outcomes.

By adopting a DVMS, enterprises are positioned to:

- Maintain Operational Stability Amidst Constant Digital Disruption

- Deliver Digital Value and Trust Across A Digital Ecosystem

- Satisfy Critical Regulatory and Certification Requirements

- Leverage Cyber Resilience as a Competitive Advantage

The Digital Value Management System (DVMS) provides leaders with a unified, evidence-based approach to governing and enhancing their digital enterprise, aligning with regulatory requirements and stakeholder expectations.

For the CEO, the DVMS provides a clear line of sight between digital operations, business performance, and strategic outcomes—turning governance and resilience into enablers of growth and innovation rather than cost centers.

For the Board of Directors, the DVMS provides ongoing assurance that the organization’s digital assets, operations, and ecosystem are governed, protected, and resilient—supported by evidence-based reporting that directly links operational integrity to enterprise value and stakeholder trust.

For the CIO, CRO, CISO, and Auditors, an integrated, adaptive, and culture-driven governance and assurance management system that enhances digital business performance, resilience, trust, and accountability.

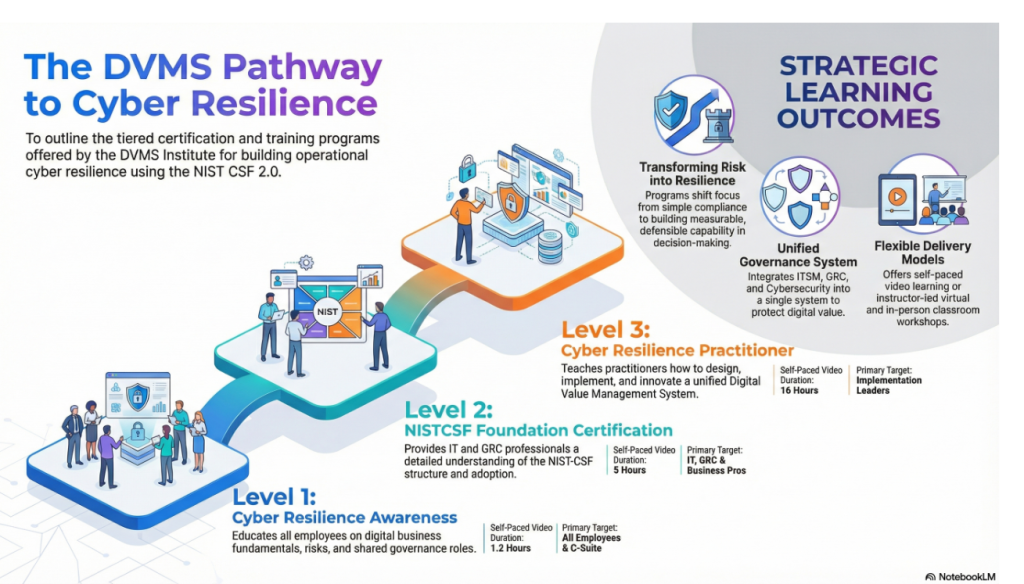

DVMS – Accredited Certification Training Program

Explainer Video – The DVMS Training Pathway to Cyber Resilience

The Digital Value Management System® (DVMS) training programs teach leadership, practitioners, and employees how to integrate fragmented systems into a unified, culture-driven governance and assurance system that accounts for the resilience of digital value within a living digital ecosystem.

DVMS Cyber Resilience Awareness Training

The DVMS Cyber Resilience Awareness course and its accompanying body of knowledge publication educate all employees on the fundamentals of digital business, its associated risks, the NIST Cybersecurity Framework, and their role within a shared model of governance, resilience, assurance, and accountability for creating, protecting, and delivering digital value.

DVMS NISTCSF Cyber Resilience Foundation Certification Training

The DVMS NISTCSF Cyber Resilience Foundation certification training course and its accompanying body of knowledge publications provide ITSM, GRC, Cybersecurity, and Business professionals with a detailed understanding of the NIST Cybersecurity Framework and its role in a shared model of governance, resilience, assurance, and accountability for creating, protecting, and delivering digital value.

DVMS Cyber Resilience Practitioner Certification Training

The DVMS Practitioner certification training course and its accompanying body of knowledge publications teach ITSM, GRC, Cybersecurity, and Business practitioners how to elevate investments in ITSM, GRC, Cybersecurity, and AI business systems by integrating them into a unified governance, resilience, assurance, and accountability system designed to proactively identify and mitigate the cyber risks that could disrupt operations, erode resilience, or diminish client trust.

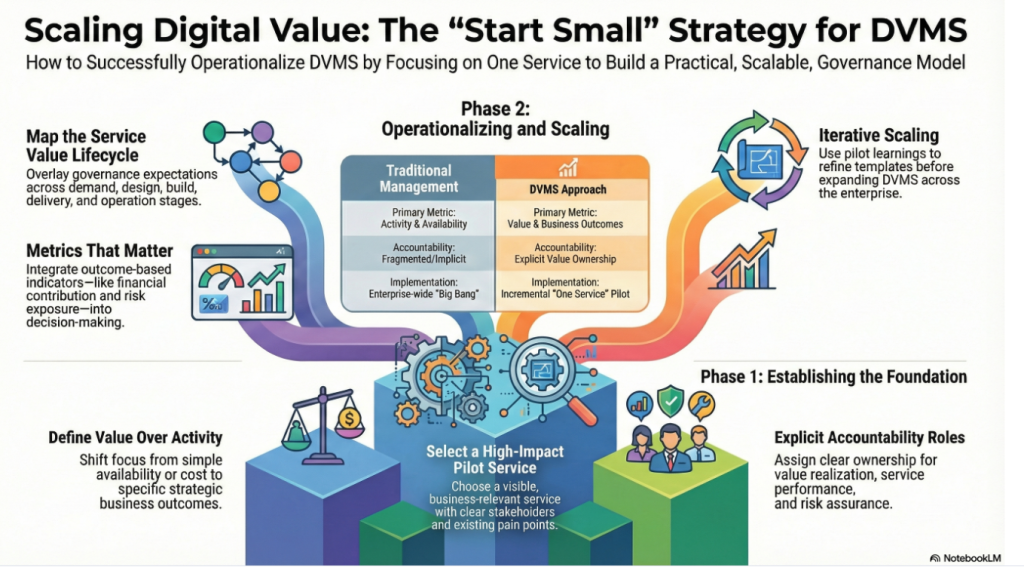

A FastTrack Approach to Launching Your DVMS Program

Explainer Video – Scaling a DVMS Program

The DVMS FastTrack approach is a phased, iterative approach that helps organizations mature their DVMS over time, rather than trying to do everything simultaneously.

This approach breaks the DVMS journey into manageable phases of success. It all starts with selecting the first digital service you want to make cyber resilient. Once that service becomes resilient, it becomes the blueprint for operationalizing cyber resilience across the enterprise and its supply chain.

Company Brochures and Presentation

Explainer Videos

- DVMS Architecture Video: David Moskowitz explains the DVMS System

- DVMS Case Study Video: Dr. Joseph Baugh Shares His DVMS Story.

- DVMS Overlay Model – What is an Overlay Model

- DVMS MVC ZX Model – Powers the CPD

- DVMS CPD Model – Powers DVMS Operations

- DVMS 3D Knowledge Model – Powers the DVMS Culture

- DVMS FastTrack Model – Enables A Phased DVMS Adoption

Digital Value Management System® is a registered trademark of the DVMS Institute LLC.

® DVMS Institute 2025 All Rights Reserved