Third-Party Risk Management Systems – What’s Missing

Rick Lemieux – Co-Founder and Chief Product Officer of the DVMS Institute

Introduction

Third-party risk management (TPRM) has become one of the most critical disciplines in enterprise governance as organizations increasingly rely on vast networks of vendors, suppliers, and digital partners. With global supply chains growing more complex and cyber threats escalating, organizations have invested heavily in frameworks, policies, and systems to manage risks associated with external parties. Yet, despite these investments, significant gaps remain. Many TPRM programs fail to provide the agility, assurance, and resilience that modern digital ecosystems demand. This essay explores what is missing from current TPRM systems and how organizations can address those shortcomings to build stronger, more adaptive risk management practices.

Overemphasis on Compliance over Resilience

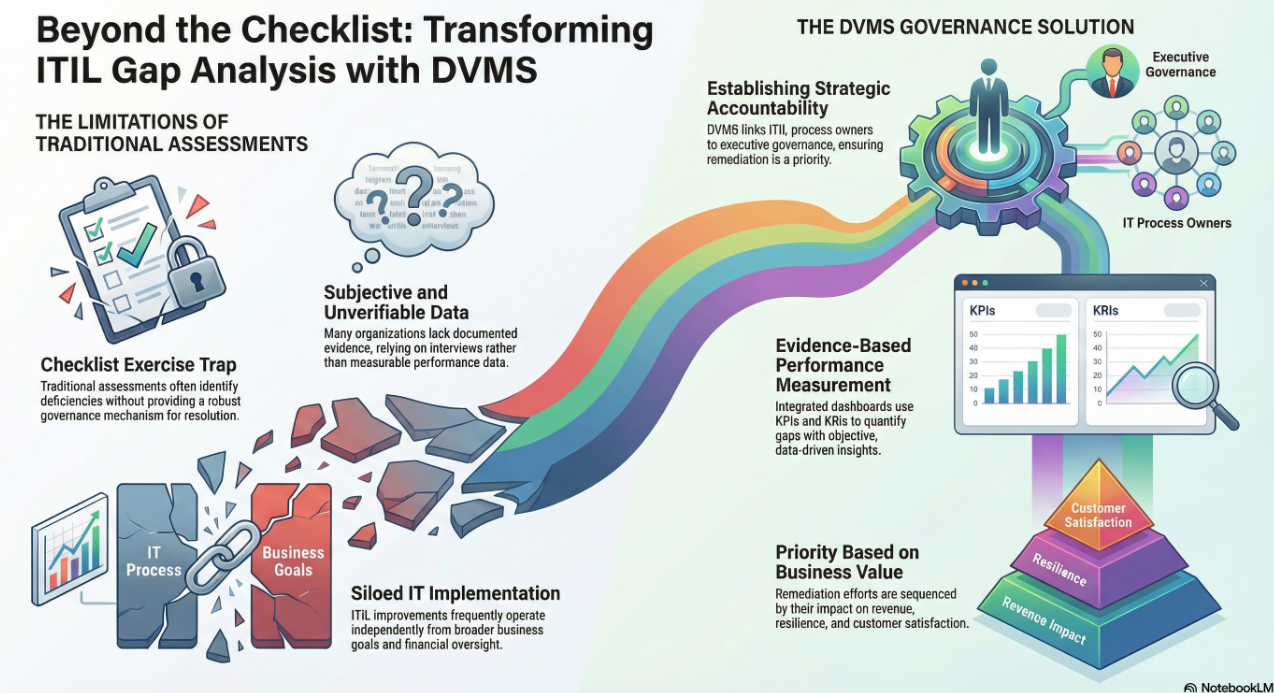

One of the most common weaknesses in TPRM systems is their focus on compliance checklists rather than true operational resilience. Organizations often measure third-party risk through static questionnaires, certifications, or regulatory requirements. While these are important, they rarely capture the dynamic nature of risks in today’s environment. For instance, a vendor may be compliant at the time of audit but still vulnerable to a ransomware attack weeks later. What is missing is a shift from “point-in-time compliance” to continuous assurance—where resilience and adaptability are prioritized over mere certification.

Static and Infrequent Assessments

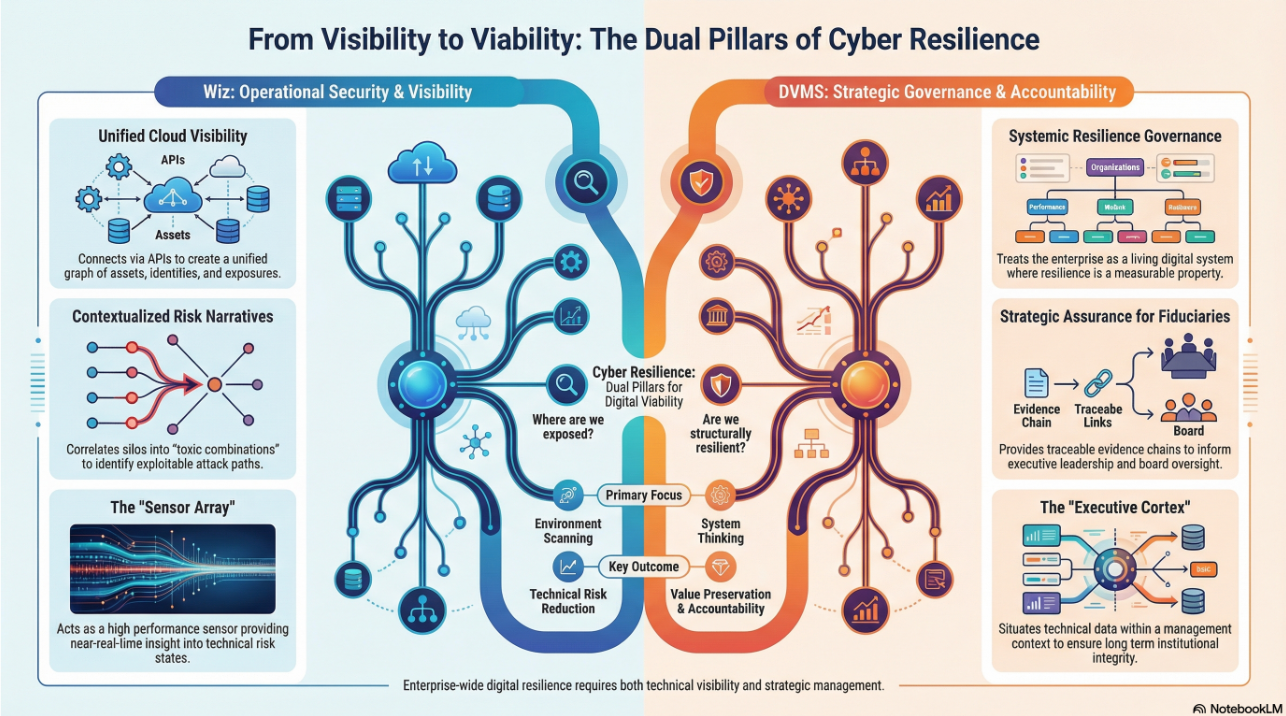

Most TPRM systems conduct periodic reviews—annually, semi-annually, or upon contract renewal. This cadence does not reflect the pace of risk in a digital ecosystem. Cyber threats evolve daily, supply chain disruptions can occur overnight, and regulatory changes can emerge unexpectedly. Relying on infrequent assessments leaves organizations exposed during the long gaps between reviews. What is missing is real-time risk monitoring, powered by automation, analytics, and continuous data feeds that dynamically track vendor health, cyber posture, and financial viability rather than periodically.

Lack of End-to-End Supply Chain Visibility

Traditional TPRM programs often focus narrowly on direct, first-tier vendors. Yet, many devastating disruptions originate deeper in the supply chain. For example, a critical supplier may rely on another subcontractor vulnerable to cyber threats or geopolitical instability. Because visibility often stops at the first tier, organizations miss hidden risks that can cascade through the supply chain. What is missing is a multi-tier supply chain risk perspective that maps dependencies beyond direct relationships and identifies weak links several layers deep.

Limited Integration with Business Strategy

Another gap is the disconnect between TPRM and broader business strategy. Many organizations treat third-party risk as a siloed compliance or procurement function rather than a core enabler of strategic resilience. As a result, third-party risk insights often fail to influence decision-making in digital transformation, mergers and acquisitions, or innovation initiatives. Strategic alignment is missing—ensuring that third-party risk management is integrated into governance structures and directly tied to business objectives, value creation, and resilience outcomes.

Inadequate Cultural Integration

TPRM programs often overlook the cultural dimensions of risk management. While policies and systems may exist, the mindset of shared accountability across the organization is frequently absent. Business units may see TPRM as “someone else’s job” rather than a shared responsibility. This leads to gaps in execution, as stakeholders fail to report vendor issues or comply with onboarding processes. What is missing is a risk-aware culture that embeds third-party risk considerations into everyday decision-making, empowering employees to treat risk management as a collective responsibility rather than a compliance task.

Weakness in Cybersecurity Integration

Cyber risk has become the defining dimension of third-party risk. Yet, many TPRM programs remain heavily weighted toward financial, legal, and reputational risks, with cybersecurity treated as another checkbox. As cyberattacks on supply chains intensify, this approach is inadequate. What is missing is deep cybersecurity integration—including security-by-design in vendor contracts, ongoing monitoring of vendor security controls, threat intelligence sharing, and alignment with cybersecurity frameworks such as NIST CSF or ISO 27001. Without this, organizations cannot ensure that third parties are capable of withstanding modern threat vectors.

Limited Use of Technology and Automation

Despite the availability of advanced technologies, many TPRM systems still rely heavily on manual processes, spreadsheets, and email-based questionnaires. This slows down assessments, reduces accuracy, and increases human error. It also makes scaling TPRM across thousands of vendors impractical. What is missing is automation and analytics—tools that leverage artificial intelligence, machine learning, and natural language processing to process vendor data, detect anomalies, and generate actionable insights. Automated platforms can dramatically improve efficiency while providing real-time risk visibility.

Insufficient Focus on Resilience Metrics

When TPRM programs measure performance, they often focus on surface-level metrics such as the number of vendors assessed or the percentage of completed questionnaires. These metrics offer little insight into actual resilience. What is missing are resilience-driven metrics such as mean time to recovery (MTTR) for critical vendors, continuity of services during disruptions, or the effectiveness of vendor incident response plans. Such metrics help organizations assess whether vendors can deliver value under adverse conditions, not just whether they are compliant on paper.

Gaps in Cross-Functional Collaboration

TPRM frequently struggles due to a lack of coordination between procurement, cybersecurity, risk management, compliance, and operations. Each team may manage vendor risks from its own perspective, creating duplication of effort and fragmented views of risk. Cross-functional collaboration is missing, where information and accountability are shared across the enterprise. A truly effective TPRM system requires integrating diverse functions into a single governance framework, supported by shared data platforms and decision-making processes.

Failure to Support Continuous Adaptation

Risk environments evolve rapidly, yet many TPRM systems are designed as static programs. They lack mechanisms to capture lessons learned, feedback, incident insights, or update practices in response to emerging risks. This creates rigidity and an inability to adapt quickly. What is missing is a continuous improvement loop that ensures third-party risk management evolves as threats, technologies, and markets change. Adaptive frameworks that grow with the environment are essential to sustaining resilience in the long term.

Insufficient Assurance to Stakeholders

Finally, many TPRM systems fail to provide clear, continuous assurance to key stakeholders—boards, regulators, and customers. Reports are often backward-looking, limited in scope, or overly technical, making it difficult for leaders to understand the proper risk posture. Embedded assurance is missing, where risk data is continuously collected, validated, and communicated transparently and business-relevantly. These build trust within the organization and with regulators, investors, and clients.

Using an Overlay System to Close the Gaps in Third-Party Risk Management Systems

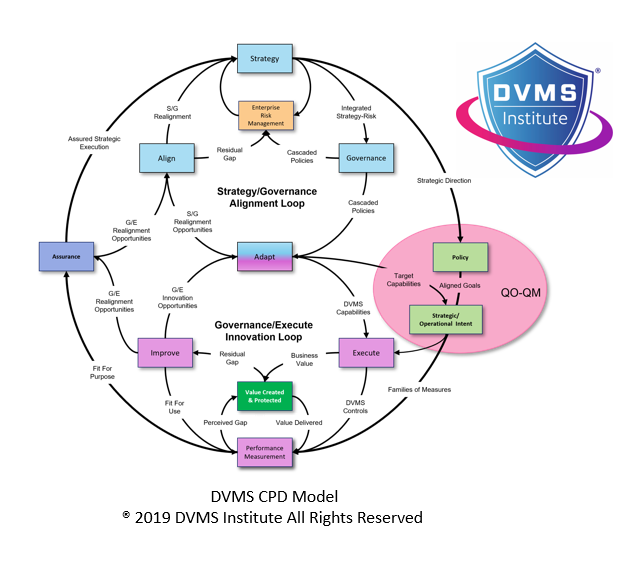

A Digital Value Management System® (DVMS) from the DVMS Institute elevates existing third-party risk management programs (TPRM) into an integrated, culture-driven Digital Value Management System® (DVMS) that powers adaptive governance, operational resilience, and performance assurance across complex digital supply chains.

The DVMS—driven by its MVC, CPD, 3D Knowledge, and FastTrack models— elevates existing TPRM programs by uniting Strategy, Governance, Operations, and Culture into a single adaptive overlay system that continuously strengthens and innovates digital business performance, resilience, compliance, and trust.

Conclusion

Third-party risk management systems are critical for safeguarding modern organizations, but they are too often reactive, compliance-driven, and siloed. What is missing is a shift toward continuous monitoring, multi-tier visibility, deep cybersecurity integration, automation, resilience-focused metrics, cultural embedding, and cross-functional collaboration. By addressing these gaps, organizations can transform TPRM into a proactive, adaptive, and value-driven discipline that mitigates risks and strengthens the digital ecosystem’s resilience and trust. In a world where supply chains and third-party networks define business success, evolving TPRM systems is not just a necessity—it is a strategic imperative for survival and growth.

About the Author

Rick Lemieux

Co-Founder and Chief Product Officer of the DVMS Institute

Rick has 40+ years of passion and experience creating solutions to give organizations a competitive edge in their service markets. In 2015, Rick was identified as one of the top five IT Entrepreneurs in the State of Rhode Island by the TECH 10 awards for developing innovative training and mentoring solutions for boards, senior executives, and operational stakeholders.

Traditional best-practice approaches to IT Service Management (ITSM), Governance, Risk and Compliance (GRC), and Cybersecurity are insufficient to manage today’s complex digital ecosystems’ resilience, compliance, and trust requirements.

The DVMS Institute Certified Training programs and publications provide detailed guidance on evolving any best-practice program into an integrated, Digital Value Management System® (DVMS) capable of transforming systemic cyber risk into operational resilience.

The DVMS seamlessly aligns organizational Strategy, Governance, Operations, and Culture into an integrated, adaptive, and culture-driven governance and assurance system capable of ensuring resilient, compliant, and trusted digital outcomes.

By adopting a DVMS, organizations are positioned to:

- Maintain Operational Stability Amidst Constant Digital Disruption

- Deliver Digital Value and Trust Across A Digital Ecosystem

- Satisfy Critical Regulatory and Certification Requirements

- Leverage Cyber Resilience as a Competitive Advantage

DVMS Explainer Videos

- Architecture Video: David Moskowitz explains the DVMS System

- Case Study Video: Dr. Joseph Baugh Shares His DVMS Story.

- Overlay Model – What is an Overlay Model

- MVC ZX Model – Powers the CPD

- CPD Model – Powers DVMS Operations

- 3D Knowledge Model – Powers the DVMS Culture

- FastTrack Model – Enables A Phased DVMS Adoption

Digital Value Management System® is a registered trademark of the DVMS Institute LLC.

® DVMS Institute 2025 All Rights Reserved