Shift from Static GRC to Dynamic GRA

David Nichols – Co-Founder and Executive Director of the DVMS Institute

Traditional approaches to governance, risk, and compliance (GRC) are no longer sufficient in a world of relentless disruption. Organizations must adapt — and thrive — by embedding dynamic capabilities directly into creating, protecting, and delivering digital business value.

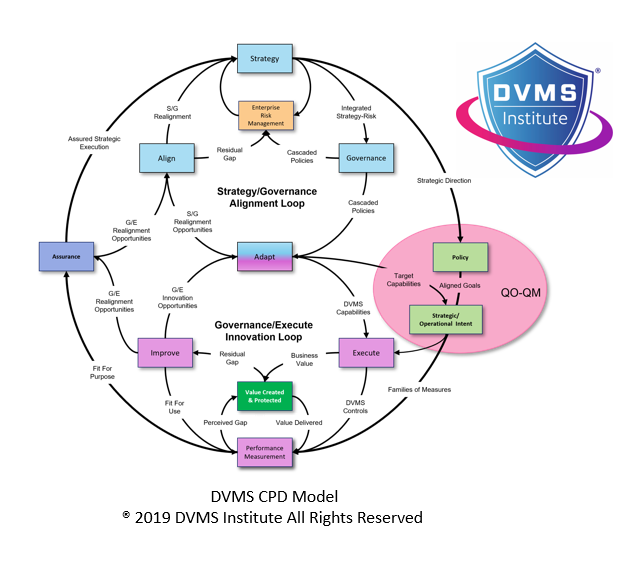

Thriving on the Edge of Chaos introduces the Digital Value Management System (DVMS) to achieve this transformation. Central to the DVMS is the Risk Team—a permanent, empowered, cross-functional team with the capability to make the shift from static GRC to dynamic Governance, Resilience, and Assurance (GRA) possible.

The Problem with Static GRC

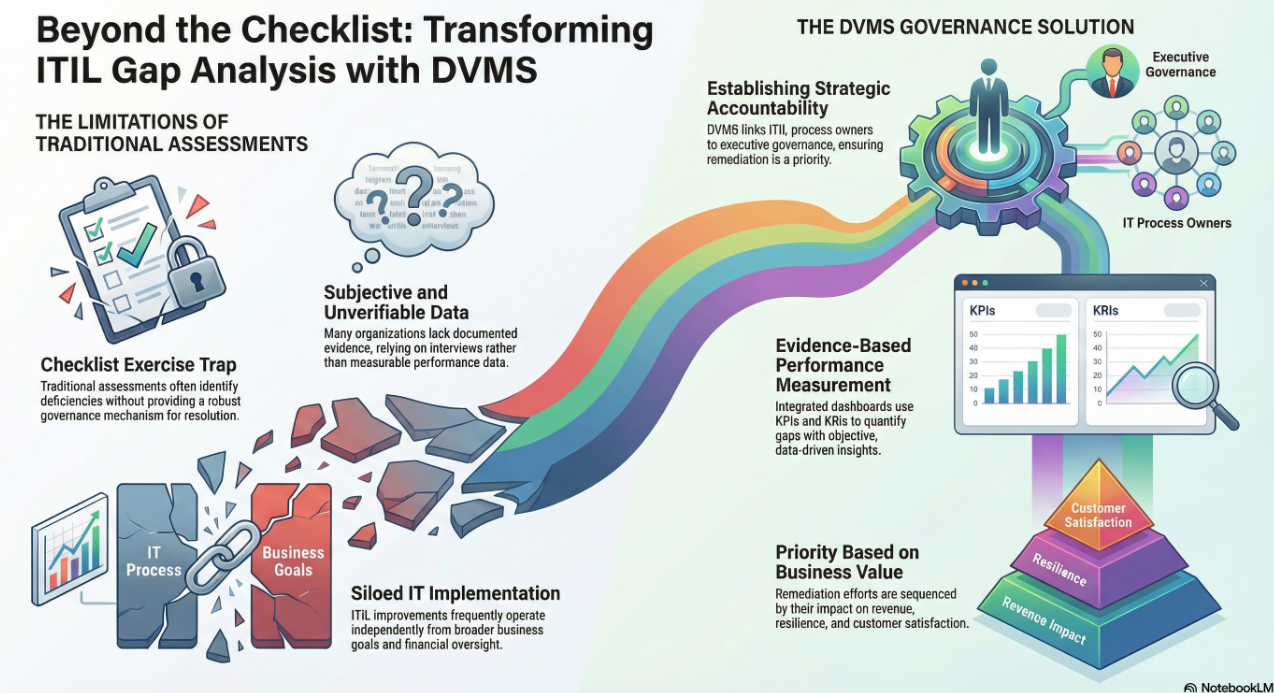

The traditional GRC model assumes a relatively stable environment, where risks can be cataloged, policies written, and compliance verified on a set schedule. However, static GRC frameworks are ill-suited for the volatile, uncertain, complex, and ambiguous (VUCA) reality organizations face today. Governance is typically top-down and detached from operational execution. Risk management is often siloed and reactive, focused more on documenting incidents after they occur than on anticipating disruptions. Compliance activities become checkbox exercises, disconnected from actual value creation or protection.

This static approach leaves organizations vulnerable—unable to govern at the speed of change, adapt their resilience strategies dynamically, and assure that strategic policies achieve their intended outcomes in real-world, evolving conditions.

The DVMS Approach: Toward Dynamic GRA

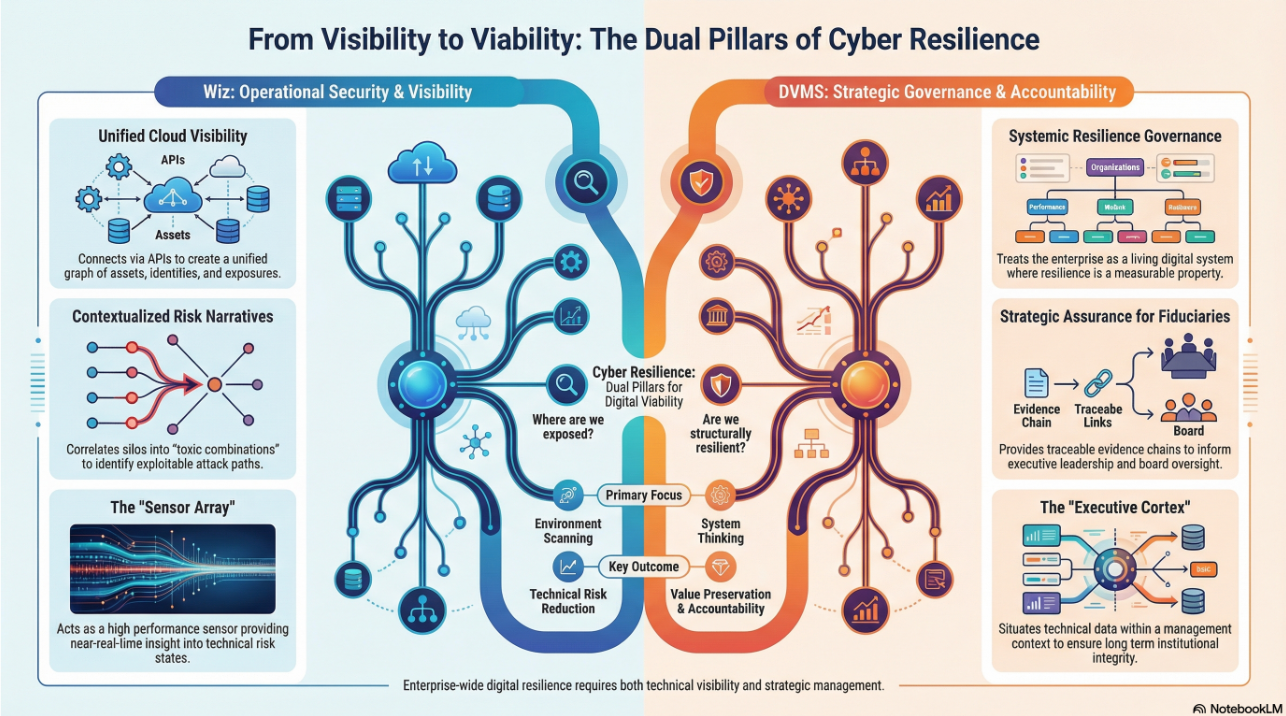

The Digital Value Management System (DVMS) offers a fundamentally different approach — one built for dynamism, not stability. Governance under DVMS is not a periodic review but a continuous, embedded activity that guides daily decisions and actions. Resilience is not merely a post-incident recovery strategy; it is designed into the organizational DNA, workflows, and culture from the outset. Assurance is not an annual audit but a living, breathing validation of how well strategic policies are being executed in practice.

By structuring governance around the Create, Protect, and Deliver (CPD) cycle of digital business value, DVMS ensures that value creation initiatives, protective controls, and delivery mechanisms are aligned, monitored, and adjusted dynamically. In doing so, DVMS transforms governance from a burden into an enabler — a way for organizations to operate at the speed and scale of disruption.

The Role of the Risk Team in Making It Happen

At the heart of this transformation is the Risk Team — not a traditional risk management function, but a cross-functional, real-time operational team tasked with governing digital value, building operational resilience, and assuring strategic outcomes.

Embedding Governance into Daily Operations

The Risk Team ensures that governance is not confined to policy documents or annual reviews but becomes an intrinsic part of how the organization creates, protects, and delivers value. They are embedded into the CPD value cycle, actively assessing whether innovation initiatives align with strategic objectives and acceptable risk parameters. They continuously monitor operational activities to ensure that protections are effective and adjust them when needed. They validate that value delivery remains consistent with governance expectations even as market, technological, and regulatory conditions shift.

This continuous, operationalized governance allows organizations to make decisions with clarity and confidence, even amid chaos, ensuring that governance is always current, relevant, and strategically aligned.

Building Operational Resilience by Design

The Risk Team also plays a crucial role in making resilience proactive rather than reactive. Rather than waiting for a crisis to expose vulnerabilities, the Risk Team leads the organization in identifying potential threats and weaknesses in advance. They continuously scan the internal and external environment for early indicators of change, assess how these changes could impact value creation and protection, and work with operational leaders to design adaptive capabilities into processes and systems.

The Risk Team facilitates scenario planning exercises to test organizational responses to various disruption scenarios, strengthening organizational readiness and flexibility. As a result, resilience is not something bolted on after an incident. Still, it is engineered into the organization’s DNA, allowing it to absorb shocks and pivot quickly in the face of adversity.

Assuring Strategic Policy Achievement in Real Time

Under the DVMS model, assurance is no longer a retrospective audit that validates compliance with policies written in the past. Instead, the Risk Team supports a continuous assurance practice that validates whether the current organizational activities and outcomes are delivering on its strategic policies.

Through real-time data collection, analysis, and reporting, the Risk Team facilitates ongoing feedback loops between operational execution and strategic oversight. They enable leadership to see in near real-time whether strategic objectives are being met, where gaps exist, and where corrective action is needed. This living assurance model ensures that governance does not lag behind operational reality but stays tightly synchronized, increasing organizational agility without sacrificing strategic coherence.

Managing Risk and Opportunity Dynamically

Finally, the Risk Team redefines the very nature of risk management. In traditional GRC frameworks, risk management is typically viewed as a brake on innovation — a compliance-driven obligation that slows progress and stifles agility. Risk is treated narrowly, as something to be avoided or mitigated after it materializes, rather than as a dynamic component of business strategy.

Operating within the DVMS model, however, the Risk Team advances a fundamentally different approach: it manages strategy-risk and opportunity as integrated, dynamic forces essential to creating, protecting, and delivering digital business value to its stakeholders. In this model, risk is not separated from strategic decision-making; instead, it is recognized as intrinsic to strategy itself.

The Risk Team continuously surfaces new risks and opportunities emerging from the operational and external environment. Through real-time sensing, analysis, and communication, they empower decision-makers at every level of the organization to act based on live intelligence. Risks are no longer hidden in technical silos or reduced to compliance checklists; they are elevated into strategic discussions, helping leaders understand how evolving threats and opportunities could impact the organizational ability to achieve its objectives.

Moreover, opportunities to create additional value are identified early, evaluated through the lens of risk appetite and strategic intent, and acted upon swiftly. This dynamic integration of risk into strategic and operational thinking transforms the organizational relationship with uncertainty.

In this way, the Risk Team moves risk management from being a barrier to progress into becoming a catalyst for responsible innovation, resilient growth, and sustained strategic advantage. By managing strategy-risk proactively, the Risk Team ensures that governance, resilience, and assurance are not afterthoughts — they continuously guide the organizational pursuit of value in a fast-changing world.

Summary: Why the Risk Team Is Critical

The Risk Team is not simply a support function but the operational heart of Governance, Resilience, and Assurance (GRA) within the DVMS. It ensures that governance is embedded into the daily operations of creating, protecting, and delivering value. It builds resilience directly into the organizational systems and behaviors. It provides continuous assurance that strategic policies are being achieved. It also enables dynamic, opportunity-driven decision-making that keeps the organization agile and competitive.

Where traditional static GRC frameworks isolate governance, risk, and compliance into reactive silos, the DVMS Risk Team integrates them into the living, breathing reality of digital business value management — allowing the organization to govern, adapt, and assure itself at the speed of change.

Bottom Line

The Risk Team is the living engine of Governance, Resilience, and Assurance (GRA) under the Digital Value Management System (DVMS). It transforms governance from a static, backward-looking exercise into a dynamic, forward-driving capability that enables organizations to survive disruption and harness it for competitive advantage.

About the Author

Dave is the Executive Director of the DVMS Institute.

Dave spent his “formative years” on US Navy submarines. There, he learned complex systems, functioning in high-performance teams, and what it takes to be an exceptional leader. He took those skills into civilian life and built a successful career leading high-performance teams in software development and information service delivery.

The DVMS Institute’s NIST Cybersecurity Framework Digital Value Management System® certified training programs teach enterprises of any size, scale, or complexity the skills to build a Holistic, Adaptive, and Culture-Powered Enterprise Cyber Resilience System and Team capable of proactively identifying and mitigating the systemic risks that impact digital business operations.

Enterprises can become resilient by embedding systemic risk management into strategic decision-making and aligning it with adaptive Governance, Resilience, Assurance, and Culture.

This unique and innovative approach to Cyber Resilience also enables enterprises to be compliant with any regulatory (SEC , UK, DORA, NIS2, SAMA, SOCI, IMO, MCU) or maturity model program (HITRUST, CMMC, C2M2, SCF).

® DVMS Institute 2024 All Rights Reserved